“To explore is not just the right of explorers. It is my experience that, in all forms of life, those willing to be adventurous, to go above and beyond, to do things that others don’t, to improve on what has come before, are the ones who create something special. And that is at the very core of what Aventum does.”

Read more

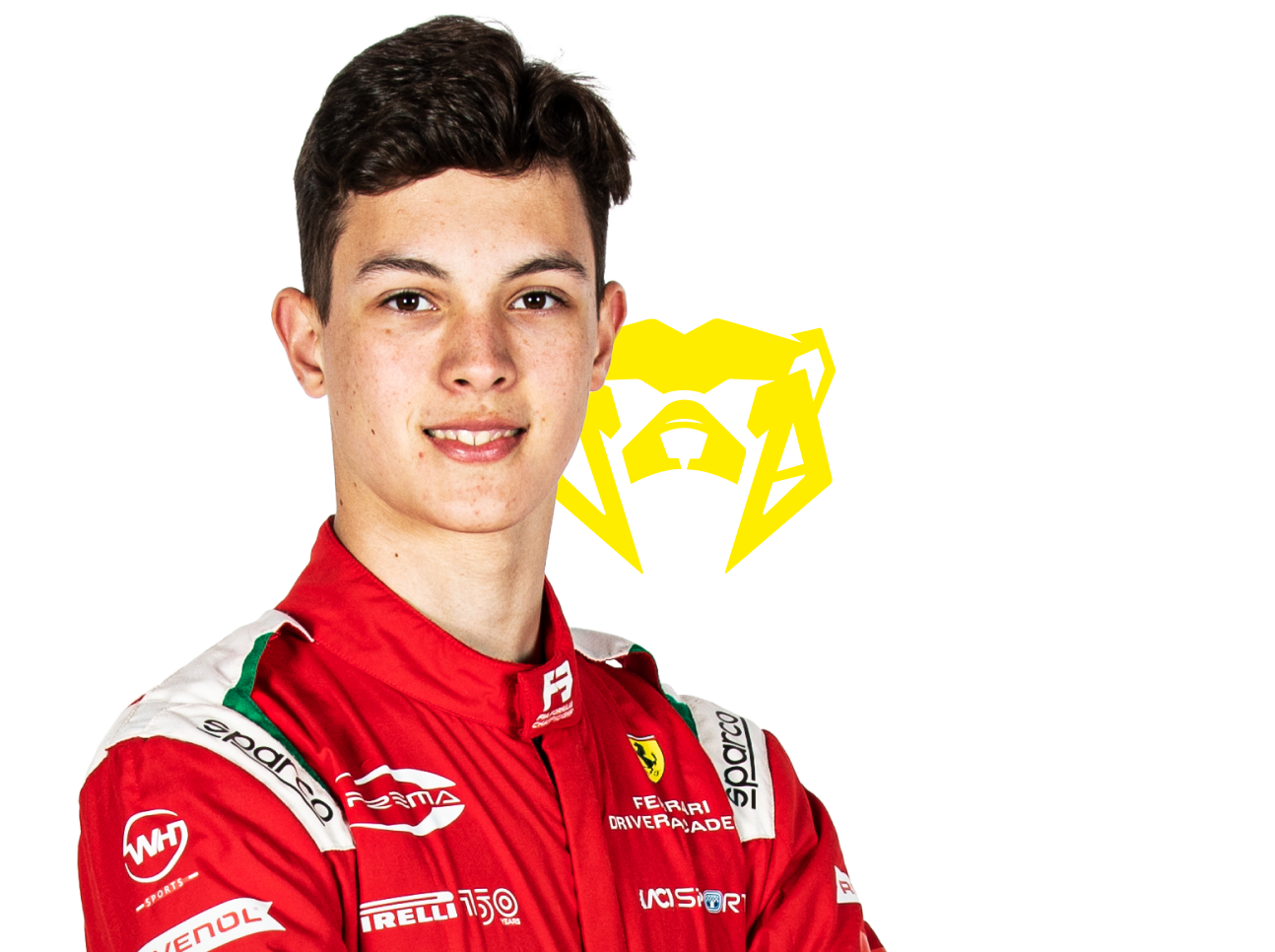

Proud Sponsors of Ollie Bearman

Your ultimate source for all things F2 as we follow Ollie on his journey through the 2024 Formula 2 racing season.

Find out more